Content

The Biggest Lie Told by Banks

Do you know what the biggest lie from banks is? It’s the belief that the money in your account will grow over time. Trusting this, you work hard, save your earnings, and deposit them into the bank, thinking it’s safe. But the truth is, your money isn’t as safe as you think.

Why? The main reason is inflation. While banks offer you an interest rate of 3% to 4%, the inflation rate is typically around 7% to 8%. This means that while the amount in your account might increase in numbers, the actual value of your money decreases.

Imagine you have 1M (in your local currency) today. After five years, your bank balance might show 1.5M due to interest. But here’s the catch today, you can buy a property for 1M. In five years, that same property might cost 20M (Inflation will influence prices more than actual demand). So even though your account balance has grown, its purchasing power has dropped.

This is why the value of your money declines it can’t keep up with rising prices. To combat this, you need to explore smart ways to grow your wealth. By investing in the right opportunities, not only can you preserve your money’s value, but you can also make it grow effectively.

What is the safest investment with the highest return low risk high return investments Where to invest money to get good returns

1st Option – Investing in Precious Metals

Precious metals like gold, silver, and platinum are popular investment options, and there’s a good reason why they’re called “precious.” The supply of these metals is very limited, which boosts their demand and value over time.

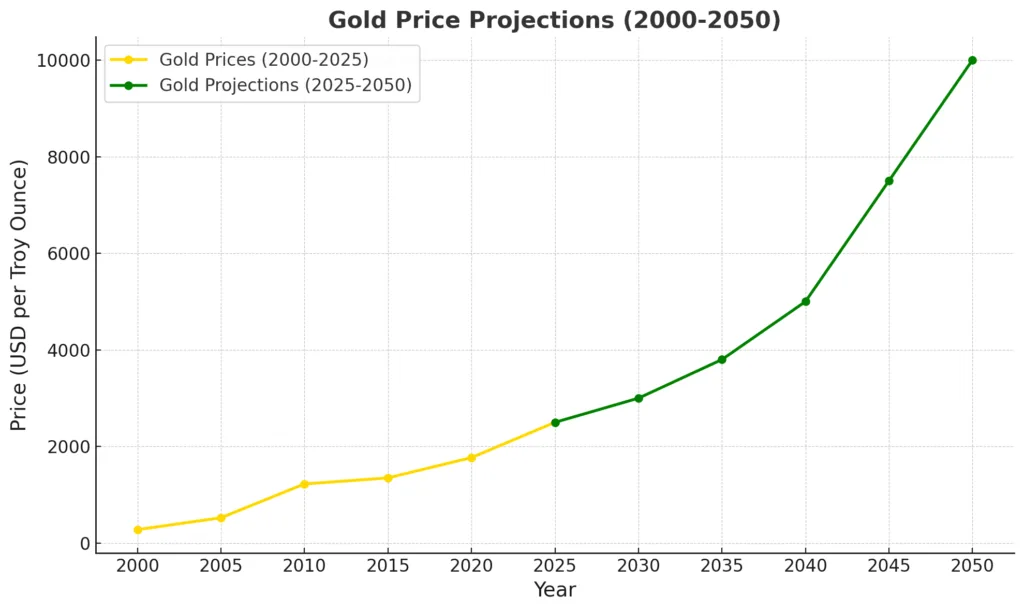

The historical and projected prices of gold, silver, and platinum per troy ounce at 10 year intervals from 2000 to 2050.

| Year | Gold (USD) | Silver (USD) | Platinum (USD) |

| 2000 | $279 | $4.95 | $549 |

| 2010 | $1,225 | $18.05 | $1,550 |

| 2020 | $1,770 | $18.40 | $970 |

| 2030 | $3,000* | $36.80* | $1,500** |

| 2040 | $5,000* | $50.00* | $2,000* |

| 2050 | $10,000* | $100.00* | $3,000* |

Note 02: For the price drop of platinum, one reason is that during uncertain times, investors often flock to gold as a safe haven asset rather than platinum, which is more industrially driven. This shift in investor preference toward gold contributed to the decline.

What is the safest investment with the highest return, low risk high return investments Best investment options for long term

Historically, gold has held a unique place in human economies. For nearly 4000 years, gold & silver coins were used as currency until about 300 years ago, when paper money became the norm. The value of these metals has remained unaffected by inflation or currency depreciation, making them a faithful choice for investments then and even now.

For example, how did gold hold ultimate power in the war economy?

In World War II, Jewish families used their gold to bribe officials, secure fake documents, or pay smugglers to help them escape from Nazi-controlled territories. Gold was usually carried in small, concealable forms like coins or jewelry. Also in East Asia, particularly in regions affected by the Japanese occupation people used gold to bribe officials for safe passage across borders to neutral or less-affected areas.

Why Is Gold Considered a Top Investment Choice?

In fact, gold is the second most profitable and low-risk investment option after real estate, based on annual investment value. Over the past 15 years, gold has delivered returns comparable to the stock market. For example, in 2010 per ounce of gold was $1,200 but, now it’s worth around $1,950–$2,000, and in 2035 it will be around $3,800–$4,000. Also, the prices of silver & platinum continue to soar annually, making them excellent investment choices as well.

So, how can you invest in these metals?

I. Physical Gold Investments:- One popular method is buying physical gold. This can be in the form of gold coins or bullion bars.

Gold is often referred to as “God’s currency,” as its value remains universal and cannot be restricted by any government. Unlike paper currency, which can lose value overnight (as seen with demonetization), gold’s value remains steady.

II. Digital Gold Investments:- Another way to invest is through digital gold. This includes options like Exchange-Traded Funds (ETFs), which function similarly to mutual funds but invest in gold instead of stocks.

What Are the Benefits of Investing in Gold and Other Precious Metals?

- Returns: Gold generally provides a return of around 10% annually, even during economic downturns.

- Low Risk: Unlike many other commodities, the risk associated with gold is minimal.

- Liquidity: Gold investments, whether physical or digital, are highly liquid. You can sell them anytime and convert them into cash easily.

- Volatility: Gold prices can fluctuate, especially during festivals or short periods, but this volatility makes it a perfect hedging investment. When markets crash, gold investments are often less affected, helping to protect your wealth.

So, investing in precious metals like gold, silver, & platinum is a smart way to maintain and grow your wealth over time. Whether you choose physical gold or digital gold, these investments can provide stable returns & financial security.

What is the safest investment with the highest return low risk high return investments

2nd Option – Land and Real Estate

Real estate has been a trusted investment method for centuries. The current (2023) global commercial real estate market size is 7.5 trillion U.S. dollars, and it is expected to grow to 9.8 trillion U.S. dollars by 2033, at an average annual growth rate of 3.08%. (Ref). Another research predicts the annual growth rate (CAGR) of 7.6% for the global commercial real estate market from 2024 to 2034. (Ref)

It’s a strategy where returns are almost guaranteed, whether through rental income or property appreciation. If you have a considerable amount of money, investing in land or real estate can be a smart way. However, even if you don’t have enough funds to buy a property outright, still you can be a real estate investor.

You Can Be a Real Estate Investor Without Owning Physical Property?

Absolutely, such an option is REITs (Real Estate Investment Trusts). It is similar to mutual funds but focused on real estate instead of stocks. In a REIT, a group of investors pools their money, then it will be used to invest in commercial properties like malls, offices, and shops, or residential projects such as apartments, hostels, and houses.

How Do REITs Work?

- The trust managers utilize the pooled funds to buy & manage properties.

- The rental revenue yielded from these properties is distributed to shareholders from its profits.

- Even, as the market value of the properties appreciates, the price of your REIT units grows, reflecting the change in your investment.

- Also, the REITs investments offer flexibility. If you ever need cash, you can easily sell your REIT units and withdraw your funds.

So, real estate, whether through direct ownership or REITs, remains a reliable investment opportunity with hopeful returns & liquidity.

What is the safest investment with the highest return low risk high return investments

3rd Option – Value Stocks & Mutual Funds

Some people hesitate to join the stock market due to its perceived risks. Some avoid it entirely, while others dive in without proper research, expecting to get rich overnight, only to lose their investments. However, many take the time to understand the market and engage in intelligent investing to earn profits.

For those seeking stable returns in the stock market, there are two simple and effective options: Value Stocks and Mutual Funds.

I. Value Stocks

Value stocks are shares of companies that are currently undervalued, meaning their market price is lower than their intrinsic value. This investment strategy works on the belief that the stock market often overreacts to news, temporarily undervaluing even companies with strong potential.

But, for investors, this makes a chance to buy these stocks at a discounted price. Over the long term, as the stock’s value increases to match or exceed its intrinsic value, you can sell it for a significant profit.

II. Mutual Funds

Also, the mutual funds are an excellent option if you are looking for a more hands off approach to investing. In a mutual fund, a group of investors pools their money, which is then managed by a fund creator or manager.

The fund manager creates a fixed portfolio & invests the pooled money in various stocks or other assets to generate revenue. This means you don’t need to monitor the stock market continually the manager handles everything on your behalf.

Averagely, mutual funds gvies returns ranging from 12% to 15%, with medium to high risks, depending on the fund type.

A High-Risk Options

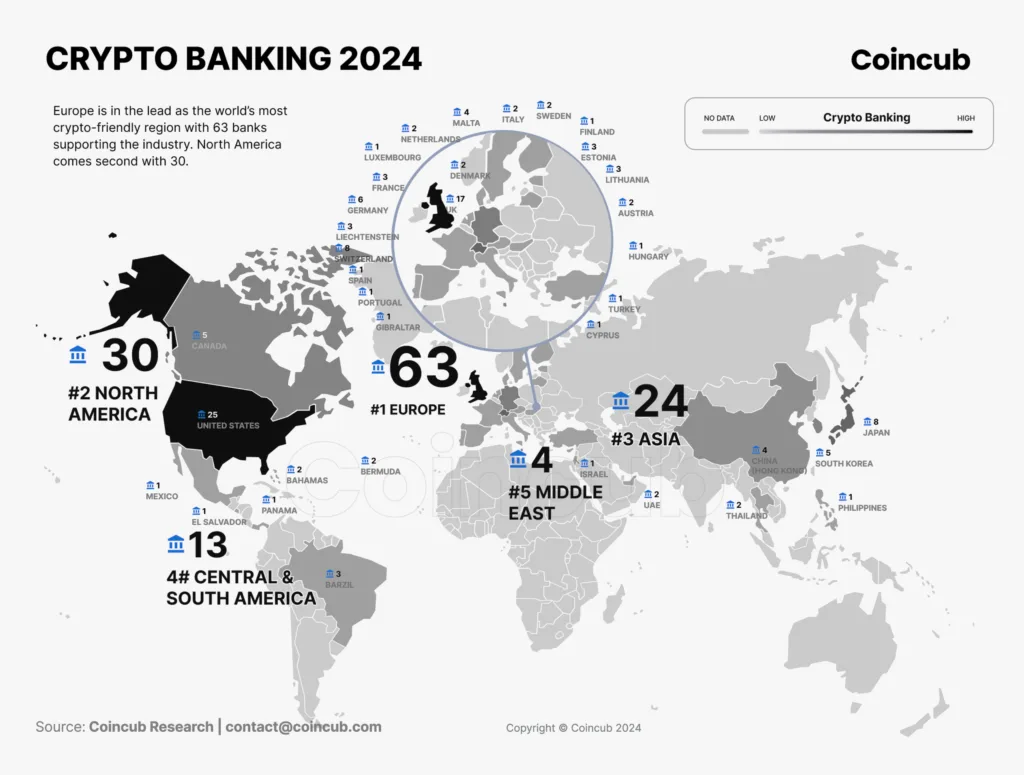

If you’re willing to take higher risks for potentially higher returns, you might consider allocating a small portion of your portfolio (1% to 2%) to cryptocurrencies. In the past year, top cryptocurrencies have delivered returns ranging from 39% to 110%.

Due to the highly volatile, experts recommend only a tiniest allocation to avoid risks while still diversifying your portfolio.

And always remember this, If you’re heading into future trades and investing your lifetime savings, there might be no ‘future’ for you!. For new investors, it’s better to focus on investing in top altcoins through spot trading and avoid Bitcoin, as Bitcoin is considered a matured asset and may be beyond the high-growth investment phase.

By balancing your investments across value stocks, mutual funds, and a small share in cryptocurrencies, you can optimize your portfolio for better returns while managing risks effectively.

What is the safest investment with the highest return low risk high return investments

4th Option – Investment in Industrial Commodities and Raw Materials

When we think of valuable metals, gold often comes to mind. However, industrial metals like copper, Lithium, Silicon, and aluminum are equally significant due to their critical roles in various industries.

- Copper:- is required for electrical appliances and wiring.

- Lithium:- Advancement of electric vehicles and renewable energy storage, lithium demand is expected to surge.

- Silicon:- A raw materials are essential for advancements in technology and the automotive sector.

- Aluminum:- For the lightweight, durable, and recyclable material, aluminum is widely used in industries ranging from aerospace to construction.

Rising Demand and Profit Potential

These industrial raw materials demands are stable and also the price rasing rapidly in recent years due to rapid technological and industrial development.

Let’s consider the price increment of copper and lithium over the years

A few years ago, copper was $4.70 per kilogram. Today, it has reached $9.41 per kilogram, approximately doubled over this period.

Similarly, the price of lithium surged from $10,000 in 2020 to $68,100 per ton by 2022, approximately 6.81 times higher, due to the emergence of renewable energy advancements. Even though the price has fallen recently due to factors such as oversupply, technological improvements in lithium extraction, and recycling, the demand for lithium continues to rise due to the growing need for renewable energy storage solutions. (Both Lithium Carbonate & Lithium Hydroxide have strong demand)

The prices of Copper, Lithium, Silicon, and Aluminum from 2000 to 2050

| Year | Copper (USD/ton) | Lithium (USD/ton) | Silicon (USD/ton) | Aluminum (USD/ton) |

| 2000 | $1,500 | $2,000 | $1,700 | $1,600 |

| 2010 | $8,800 | $6,500 | $2,000 | $2,000 |

| 2020 | $6,500 | $12,500 | $2,500 | $1,800 |

| 2030 | $10,000* | $23,000* | $3,000* | $2,500* |

| 2040 | $12,000* | $30,000* | $3,500* | $3,000* |

| 2050 | $15,000* | $38,000* | $4,000* | $3,500* |

Challenges in Physical Investment of Industrial Commodities

Despite the profit potential, investing in these materials physically has its challenges:

- Storage Issues: Storing metals like copper or cobalt requires proper facilities and comes with additional costs.

- Liquidity and Access: For an average investor, finding buyers and sellers in the raw materials market isn’t straightforward.

A Smarter Alternative for average investor

Instead of purchasing raw materials directly, you can invest in mining companies that extract and sell these metals. These companies benefit from the rising demand for raw materials, and by investing in them, you indirectly profit from the commodities market.

What is the safest investment with the highest return low risk high return investments Where to invest money to get good returns

5th Option – Safe Haven Currencies

When you think of Swiss bank accounts, images of safe vaults & secret savings often come to mind. Have you ever thought about why global leaders, celebrities, and even billionaires gravitate toward Swiss accounts? The answer lies in safe haven currencies, with the Swiss Franc being a prime example.

What Are Safe Haven Currencies?

Safe haven currencies are those that remain stable or even increase in value during global crises. These currencies are supported by nations with:

- Strong political stability

- Robust economic systems

- Minimal inflation and devaluation risks

These safe haven currencies have high stability.

- Swiss Franc (CHF)

- US Dollar (USD)

- Japanese Yen (JPY)

- British Pound (GBP) Among these, the Swiss Franc is considered one of the most Strongest & Reliable.

Why the Swiss Franc?

During economic crises like the 2008 breakdown or recent geopolitical events like the Russia-Ukraine war, the Swiss Franc displayed remarkable resilience. Its stability has made it a trusted currency even in volatile times.

Let’s imagine:- If you hold $50000 (in your currency) during a severe economic crisis, inflation could erode its value to $35000. However, if you had converted it to Swiss Francs, its value might increase to $100000 or even more when exchanged back after a few years. This resilience is why many see the Swiss Franc as a financial shield during economic turbulence.

How to Invest in Safe Haven Currencies?

An average person may find it difficult to open a Swiss bank account to benefit from safe-haven currencies. But, you can:

- Invest in Currency ETFs: These allow you to invest in foreign currencies easily.

- Trade in Forex: Platforms allow trading in safe haven currencies.

Advantages of Currency Investment

- Liquidity: You can withdraw your funds easily whenever required.

- Low Volatility: Unlike stocks or crypto, safe haven currencies don’t fluctuate wildly, ensuring better financial security.

Investing in safe haven currencies like the Swiss Franc is a smart way to protect your money from inflation and economic crises. It’s a reliable alternative for those looking for stability in a volatile market.

What is the safest investment with the highest return low risk high return investments Where to invest money to get good returns

6th Option – Investing in Collectibles

Collectibles are rare items highly desired after by fans and collectors around the world. These could include vintage cars, limited edition items, old coins, stamps, paintings, trading cards, and more. While collectibles are often associated with personal passion, they can also become a lucrative asset when approached wisely.

What Makes Collectibles Valuable?

The value of a collectible is determined by its rarity, historical significance, and the passion of potential buyers. The price of a collectible often raises based on it ages, and its worth mainly depends on how much someone is willing to pay for it.

For example, Leonardo da Vinci’s controversial painting Salvator Mundi sold for a staggering $450 million in an auction, purchased by Saudi Crown Prince Mohammed bin Salman. Also, In 1986, artist Jeff Koons created a Rabbit in stainless steel, which later sold for $91 million in an auction. (Ref)

List of Popular Collectibles

- Titanic Memorabilia: Items related to the Titanic are immensely famous among collectors and can buy excessively high prices.

- Vintage Cars: Classic models of Ferrari, Lamborghini, or Rolls Royce hold huge value.

- Coins and Stamps: Rare and old currency or postage stamps are highly desired by numismatists and philatelists.

- Trading Cards: Sports or game cards, such as Pokémon or baseball cards, also in high demand.

- Art & Sculptures: Paintings by well-known artists or unique sculptures often sell for millions.

The Business Side of Collectibles

If you aim to profit from collectibles, this process is called collectibles investing. Here’s what to keep in mind:

- Initial Costs: Collectibles often require significant upfront investment. For example, buying rare art or vintage cars demands a big budget.

- Maintenance: Items like paintings, cars, or antiques need proper care, which can be expensive.

- Market Trends: The resale value depends on market demand and the collector’s readiness to pay.

Not everyone can afford multi-million-dollar art or antiques, but there are budget-friendly alternatives: stamps, coins, and trading cards, which are more accessible and have active resale markets.

Advantages of Investing in Collectibles

- Portfolio Diversification: Collectibles give your investment portfolio a unique edge, balancing risks and returns.

- Pursuing Your Passion: It lets you combine investing with a personal hobby, such as art collection or vintage cars.

- Potential for High Returns: With patience and the right choices, collectibles can yield significant profits.

Collectibles not only let you to diversify your investments but also let you indulge in your passion while earning potential returns.

What is the safest investment with the highest return low risk high return investments

What is the safest investment with the highest return low risk high return investments Best investment options for long term

Here, you can find the best fundraising platform to support your financial needs.